Andreessen Horowitz (a16z) is getting a lot of attention for recently publishing a “State of Crypto” report. It’s a slick-looking, professionally produced, 56-page deck that attempts to define web3 (it really doesn’t) and offer talking points for developments in the related areas of Layer1 and Layer2 blockchains, stablecoins, DeFi, NFTs, and DAOs.

My view? The report isn’t devoid of interesting observations but it also offers a lot of delusional BS on why the world should agree with a16z’s definition of Web3 (and by extension, give them more money to manage?) It’s also self-referential by showcasing their own portfolio companies. As pundits and sycophantic tech reporters line up to laud the a16z report, I would like to call attention to a couple points a16z makes in their slideshow.

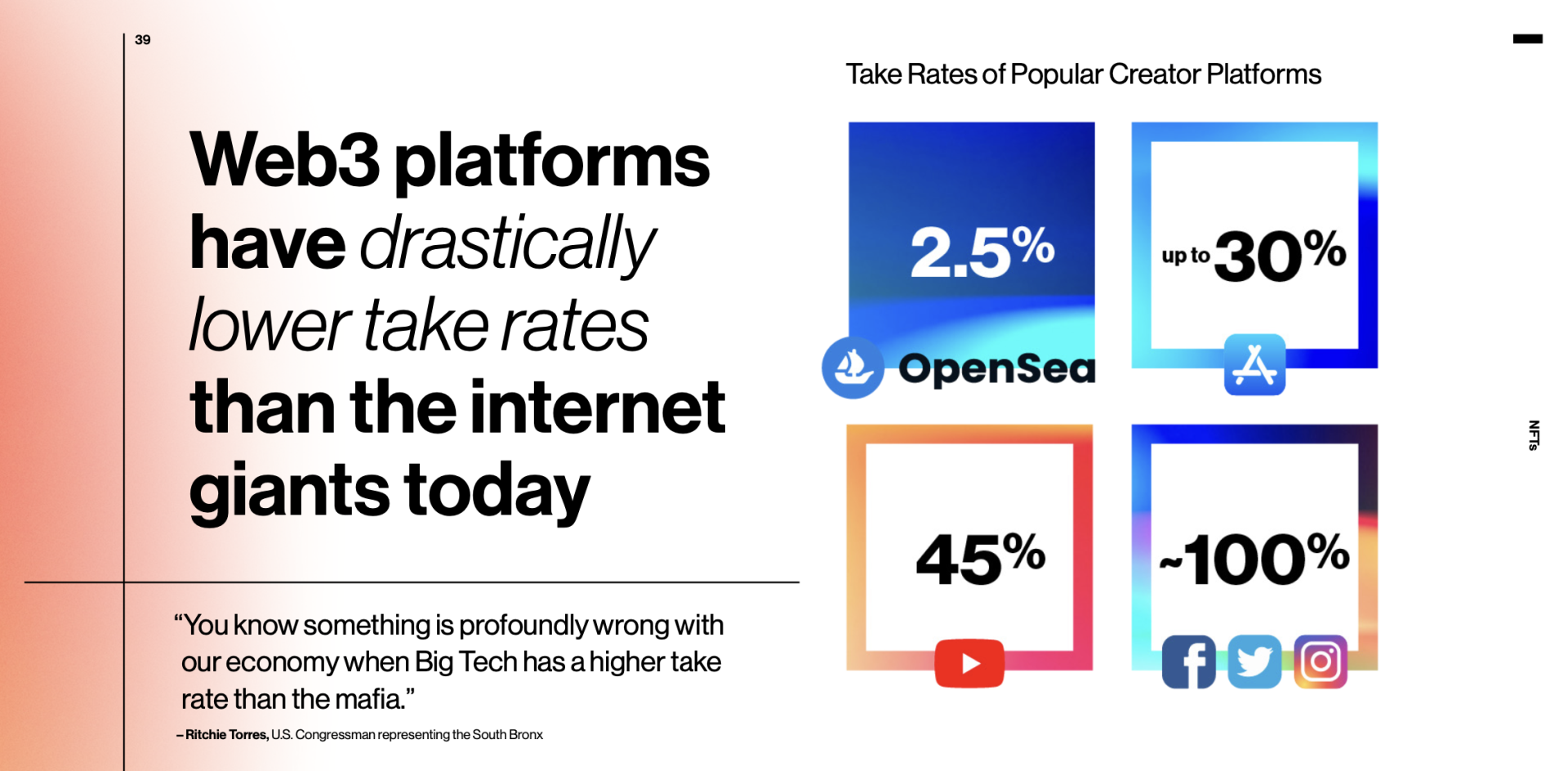

“After friendly beginnings, web2 companies have become more extractive and less cooperative” (… a valid point about BigTech). And they provide this slide as evidence on how Web3 platforms differ:

“Web3 platforms have drastically lower take rates than the internet giants today.”

Let’s consider this graphic critically:

1 - a16z highlights that OpenSea (an a16z portfolio company) only charges 2.5% while other platforms charge more from creators. It’s a hard comparison to make because of the apples to apes similarities between the platforms but also considering that 80% of OpenSea’s free-listed NFTs are stolen or fraudulent (their own admission from January). An unregulated junkyard for stolen goods doesn’t need to charge as much for maintaining the integrity of the marketplace or for protecting consumers since they do neither. Furthermore, OpenSea itself is no more a “Web3” company than eBay. But that’s a topic for another day.

2 – a16z’s report identifies Facebook and Instagram (both Meta companies) as the worst offenders taking 100% of the fruits of labor from creator class. Mark Andreessen, the founding “A” in a16z is also on the board of directors of Meta/Facebook. Given that a16z’s rhetoric is now about investing in non-extractive companies that will reward creators, how does Mr. Andreessen’s governance at Meta/Facebook figure into the equation? How can his investment firm, that helped fueled the “scale at all cost” mindset that characterizes the business model of these extractive Silicon-Valley backed companies, now proceed to damn them with any credibility? How can they claim to be part of the solution moving forward?

Short answer, they can’t.

(a16z LPs, it’s time to go elsewhere)

Note: the a16z report -- which is 2022 copyrighted with all “rights reserved worldwide” by a16z also contains a disclaimer “Views expressed in “posts” (including podcasts, videos, and social media) are those of the individual a16z personnel quoted therein and are not the views of AH Capital Management, L.L.C. (“a16z”) or its respective affiliates. AH Capital Management is an investment adviser registered with the Securities and Exchange Commission”

... so a registered investment advisor, which claims exclusive rights to this content, is not owning up to any responsibility for the material they are distributing.

Register for FREE to comment or continue reading this article. Already registered? Login here.

2

I am mystified by why anyone care what these people think about stuff that is self serving to their benefit. It is all marketing and whether they believe any of it is a function of the response they get, so it is about how much they can influence others. It is an extension of the technocrat self-referential market makers which inflate valuations for business that are not real and do not have sound fundamentals but they are great investments for passing on risk to others while the businesses lose money.